"If Nvidia is the king of AI hardware, AppLovin is the hidden king of AI software." This is the hottest sentiment on Wall Street right now. A company known just a few years ago as a mere 'mobile game publisher' has evolved into a massive platform giant, recording the highest stock growth in 2025 and eyeing a market cap of nearly $200 billion. We dissect AXON 2.0, AppLovin's secret weapon shaking up the ad market dominated by Google and Meta, and their ambitious future.

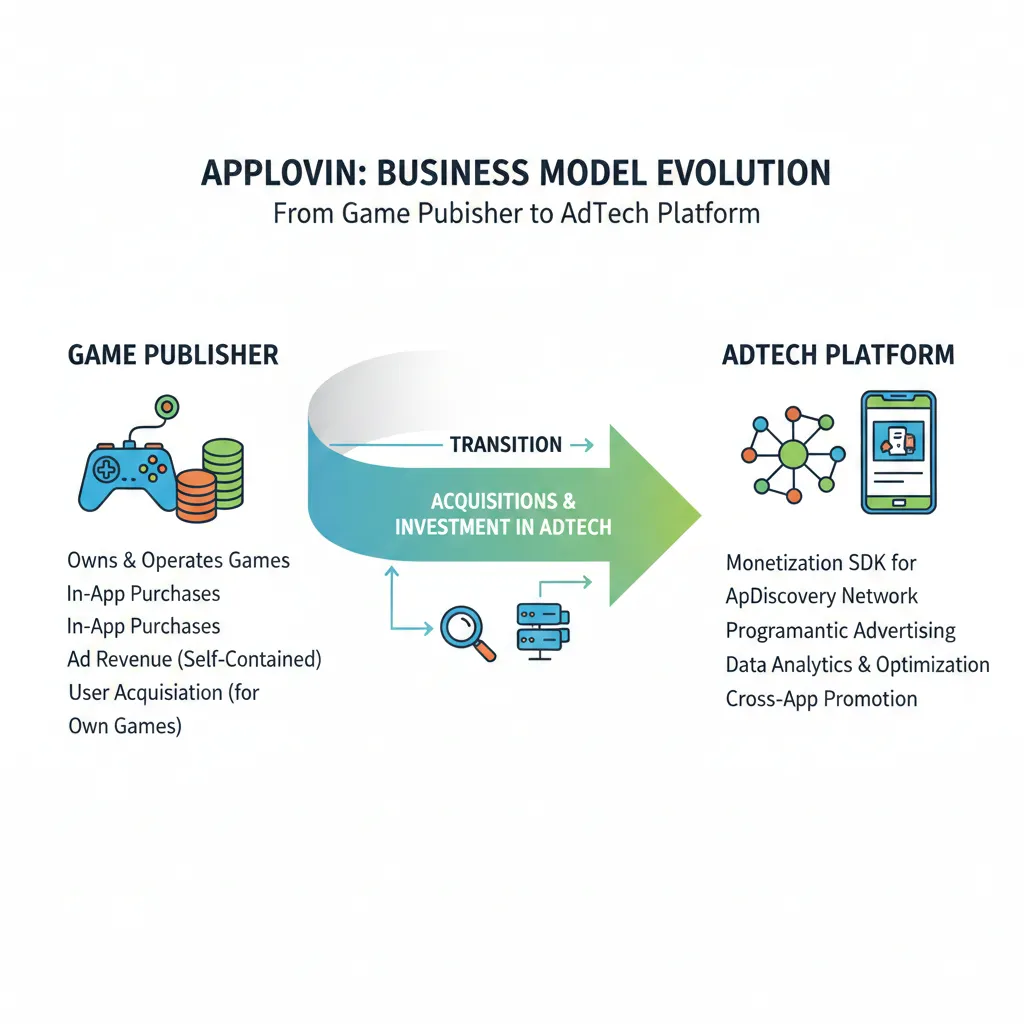

1. Not Just a Game Company, but a Tech Giant: The Pivot

When you hear "AppLovin," you might think of those 30-second ads you were forced to watch to get extra lives in a smartphone game. Or perhaps you recall them as the maker of hyper-casual puzzle games. However, defining AppLovin as just a gaming company in 2025 is like calling Nvidia just a "graphics card maker."

Why the Chicken Shop Owner Built a Delivery App

Adam Foroughi, CEO of AppLovin, made a crucial decision: **"We will divest our gaming studios."** At the time, a significant portion of AppLovin's revenue came from its own games. But he saw a bigger picture.

Let's use an analogy. Imagine you run a food delivery app, but you also own a brand called "AppLovin Chicken." Would other chicken restaurant owners want to advertise on your app? They would inevitably suspect, "Aren't they stealing my data to sell their own chicken?" This is the **Conflict of Interest** problem.

"We decided to become the Referee, not the Player. To own the stadium and provide fair technology for all players running on it." – Wall Street Analyst

AppLovin sold off its gaming division, which was essentially its limbs, for nearly $1 billion. While immediate revenue dipped, this decision proved to be a masterstroke. Competing game companies no longer saw AppLovin as a rival but as a partner delivering the best ad efficiency. As a result, the majority of the world's top mobile games now use AppLovin's solutions, transforming it into a massive platform securing data from over 1.6 billion mobile users.

2. Secret Weapon AXON 2.0: AI That Knows You Without IDFA

The core reason AppLovin's stock exploded throughout 2024 and 2025 is their AI ad engine, **AXON 2.0**. To understand why this is revolutionary, you first need to understand the 'Privacy Bomb' dropped by Apple.

Apple's ATT Policy, Meta's Stumble, and AppLovin's Opportunity

A few years ago, Apple implemented the **ATT (App Tracking Transparency)** policy. Remember the popup asking, "Allow this app to track your activity?" Most people tap "Ask App Not to Track." This dealt a massive blow to companies like Facebook (Meta) that relied on identifying individual user data (IDFA) for precise targeting. They lost visibility on things like "Male in 30s, lives in Seoul, searched for sneakers."

But AppLovin was different. Their AI engine AXON doesn't ask **"Who are you? (Identity)"**. Instead, it focuses on **"What are you doing right now? (Context & Action)"**.

How AXON Works (Contextual Targeting)

A user fails level 10 of a specific puzzle game three times in a row. It's a moment of frustration and stress. AXON detects this 'pattern of failure' in real-time. And it calculates: "This person hates complex ads right now. Show them a simple, satisfying shooting game ad to blow off steam, and there's a 90% chance they'll click."

This technology maximizes ad efficiency by understanding the user's psychological state and context without violating privacy. AppLovin trained its AI on vast amounts of gameplay data from over a billion devices worldwide. As a result, while competitors were screaming "Targeting is dead," AppLovin could shout, "Now is our time."

Especially with the upgrade to AXON 2.0, its ability to identify 'High LTV Users'—those who are likely to actually spend money within an app, not just install it—has increased dramatically. For advertisers, spending the same amount yields much higher revenue (ROAS), so there's no reason not to use AppLovin.

3. Marching into E-commerce: "Watch Ads, Buy Products"

AppLovin's ambition doesn't stop at the gaming market. Their next targets are **E-commerce** and **Connected TV (CTV)**. This is the very home turf that Google, Meta, and Amazon guard with their lives.

Shopping with Gaming Fingers?

Many investors were skeptical. "I get they are good at game ads, but buying clothes or shoes while gaming?" However, AppLovin's pilot test results were astonishing. Shoppers acquired through AppLovin's algorithms showed different patterns compared to those from existing SNS ads.

- High New Customer Acquisition: SNS algorithms show similar products based on your known tastes. But games bring in new customers from completely unexpected places. For brands, this is an opportunity to reach an 'entirely new demographic.'

- Surging ROAS: Some brands reported significantly higher returns on ad spend using AppLovin solutions compared to advertising on Meta.

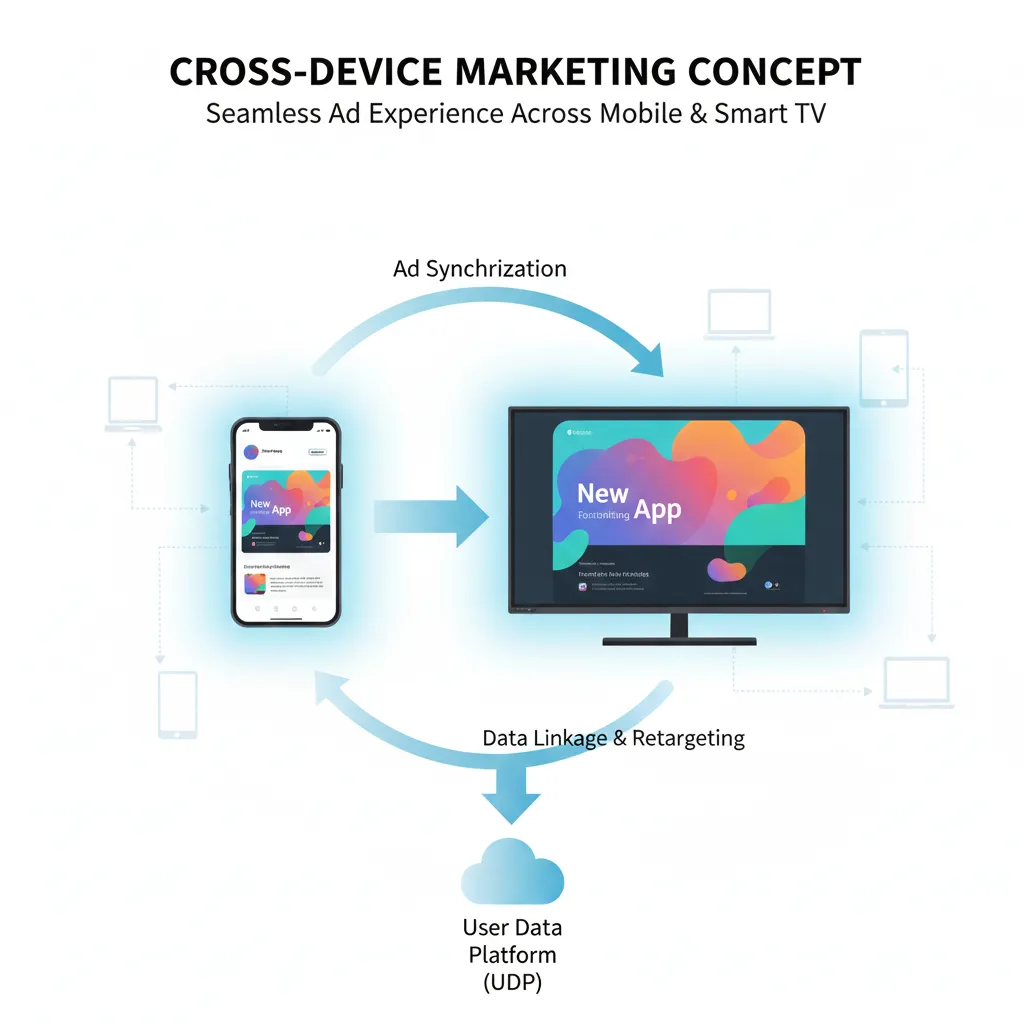

Acquiring Wurl and the TV Ad Revolution

AppLovin acquired **Wurl**, a streaming TV platform company. This is a declaration of war to bring their mobile success formula to TV. Traditional TV ads showed the same beer or diaper commercials to the whole family regardless of who was watching. Targeting was impossible.

But Connected TV powered by AppLovin's tech is different. The 30-something male who clicked a Nike sneaker ad while playing a mobile game on the subway commute comes home, turns on his smart TV, and sees a high-quality Nike brand video. This is **Cross-Device Marketing**. This massive omnichannel strategy connecting mobile and TV is a frontier that even Google and Meta haven't fully conquered yet.

4. Short Report Controversy & Wall Street Reaction

Even for the high-flying AppLovin, there were crises. In February 2025, specialized short-selling research firms 'Fuzzy Panda' and 'Culper Research' released reports attacking AppLovin simultaneously. The stock plummeted over 12% in a single day.

Short Seller Claims vs. Fact Check

The core claims of the reports were provocative:

- "AppLovin's growth is a fraud": AXON 2.0 is hyped up, and they are actually illegally scraping or stealing Meta's data.

- "Forced Installs": They trick users into installing apps without consent or show inappropriate ads to children.

- "Unsustainable Model": If Apple or Google tighten regulations, AppLovin will collapse.

However, this attack didn't last long. AppLovin immediately countered, stating it was "speculation born from a lack of understanding of the business model." Above all, the **reaction of advertisers** was the strongest defense. If AppLovin's traffic were fake bots or fraud, advertisers wouldn't see actual sales despite spending money. But advertisers continued to increase their budgets. In short, **"Numbers don't lie"** was proven.

Wall Street: "Buying Opportunity"

Major investment banks like Wedbush and Bank of America actually raised their price targets immediately after the short report. "Fundamentals are intact, and this dip is a great buying opportunity," they argued. Indeed, the stock recovered all losses within a month and hit new highs. This event confirmed that the market acknowledges AppLovin's technical moat is much deeper and solid than thought.

5. Community Reactions & 2026 Outlook

So, how are individual investors and actual developers reacting? We summarized reactions from Reddit (r/stocks, r/wallstreetbets) and major tech communities.

Voices from the Community 🗣️

- Bullish: "The next Nvidia isn't in hardware, it's in software. That is $APP.", "PE looks high, but looking at PEG (growth rate), it's still cheap.", "Advertisers were tired of the Google/Meta duopoly and looking for alternatives. AppLovin quenched that thirst."

- Bearish: "The stock is up 7x in a year. Isn't it overheated?", "Ultimately, if Apple or Google changes policy once, doesn't the structure collapse? Platform risk is too high.", "If a recession hits, ad budgets get cut first. Beware the macro environment."

- Developer Reaction: "Revenue increased by 30% after integrating MAX (AppLovin's mediation tool). I definitely feel the targeting is precise.", "Integration is easy and the dashboard is intuitive."

# ************ [Variable URL for Management] ************

# Changing this variable automatically sets article links and image paths.

GLOBAL_ARTICLE_URL = "https://agmazon.com/blog/articles/technology/202512/applovin-deep-dive-review-en.html"

ARTICLE_TAGS = ["AppLovin", "Stock", "AdTech", "AI", "Agmazon"] # Tag List

# *******************************************************

# Title

SUBJECT = 'AppLovin Analysis: The King of AI Ads Threatening Google and Meta'

# 🚀 Top Link

LINK_HTML_TOP = f"""

"""

# 💡 Bottom Link

LINK_HTML_BOTTOM = f"""

"""

CONTENT_HTML_TEMPLATE = f"""

{LINK_HTML_TOP}

Hello! This is Agmazon Blog.

We are sharing an in-depth analysis of AppLovin.

[Summary]

✅ Complete transformation from game company to AI ad platform

✅ Secret weapon AXON 2.0 and E-commerce/CTV expansion strategy

✅ Analysis of short report controversy and Wall Street/Community reactions

Thank you!

Click the link below to view the full article.

{LINK_HTML_BOTTOM}

"""Conclusion: Bubble or New Paradigm?

AppLovin's 2025 was spectacular. But a high stock price implies high expectations. Every quarterly earning call from now on, the market will rigorously verify "if growth is slowing" and "if e-commerce expansion is going as planned." The potential minefield of privacy regulations also remains.

However, it is clear that AppLovin is not a company that succeeded merely by luck. They believed in the power of software when others were obsessed with hardware, and they built an AI engine to interpret data when others were frantic to collect it. AppLovin has now become a massive software infrastructure converting the time of 1.6 billion people worldwide into money. We look forward to seeing if they can dismantle the strongholds of Google and Meta and ascend as the true 'Emperor of AdTech' in 2026.