In 2025, Bitcoin made history once again. But after the fireworks, a strange silence and anxiety hang over the market. On-chain data is sending 'warnings,' and the community is divided between 'HODL' and 'Profit Taking.' Are we simply going through a correction, or are we standing at the entrance of a 'Crypto Winter' in 2026? We uncover the signals you must check now to protect your wallet.

1. Current Status: Is the Party Over?

December 25, 2025. Merry Christmas, but the Bitcoin chart doesn't look very happy. The explosive bull run that began in late 2024 peaked in mid-2025 and is currently showing a sideways downtrend. Many investors expected a 'Santa Rally,' but the market is suffering from a liquidity crunch instead.

🚨 Key Summary: Current Market Characteristics

- Volume Plunge: Trading volume has dropped by more than 40% from the peak, indicating a lack of buying pressure.

- ETF Outflows: Net outflows have occurred in spot ETFs for 4 consecutive weeks, accelerating institutional profit-taking.

- Altcoin Collapse: While Bitcoin dominance remains high, altcoins are recording declines of -60% or more from their peaks.

This phenomenon is a typical characteristic of the 'late cycle.' It shows a pattern surprisingly similar to when we entered the bear market in 2022 after the peak in November 2021.

"History doesn't repeat itself, but it often rhymes. The current chart is showing a déjà vu of 2021." – Famous Crypto Analyst PlanB (Hypothetical Quote)

2. Warning Signals from On-Chain Data

Charts can lie, but data recorded on the blockchain does not. Current on-chain indicators are clearly pointing to 'Caution.'

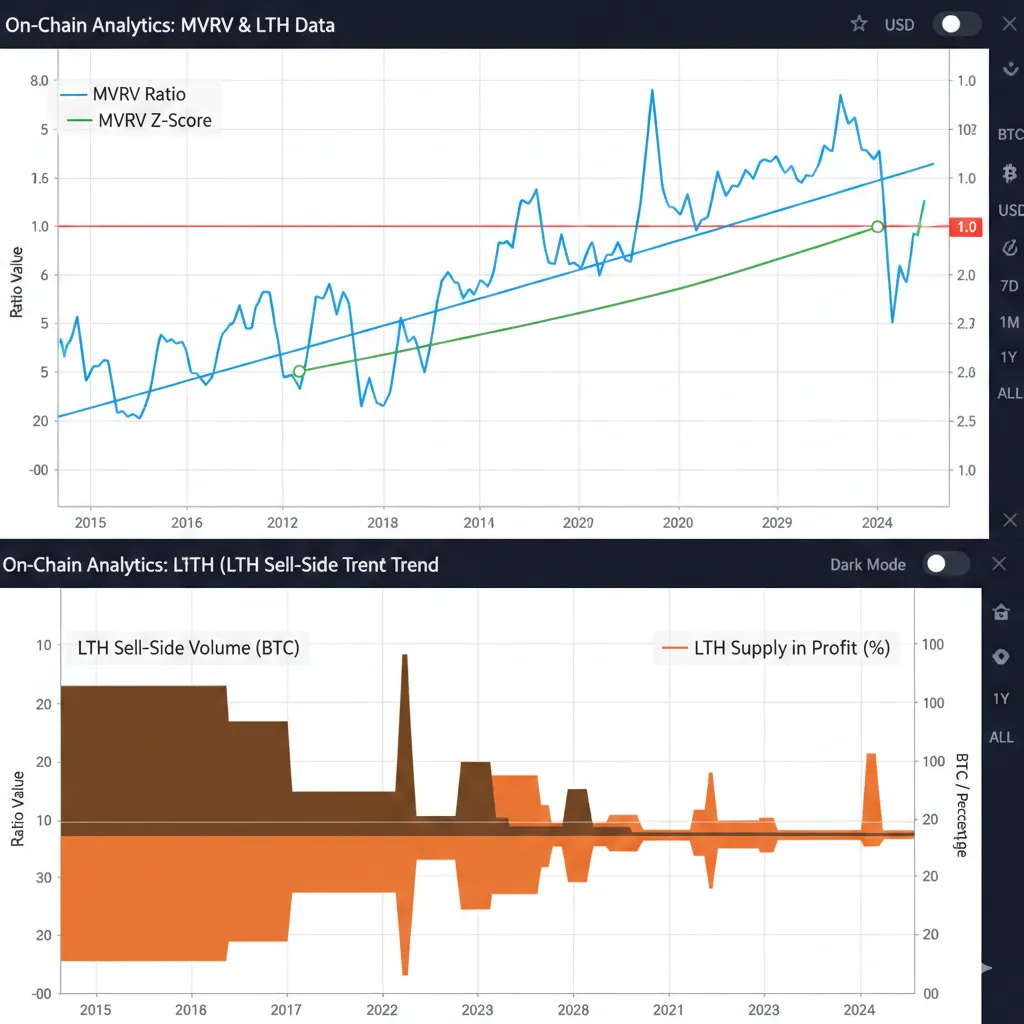

Declining MVRV Ratio

The Market Value to Realized Value (MVRV) ratio is coming down from the danger zone. This means market participants are realizing profits and leaving. In particular, the increasing stop-loss volume from Short-Term Holders (STH) suggests the possibility of further declines.

Movements of Long-Term Holders (Whales)

| Category | Status | Interpretation |

|---|---|---|

| Wallets > 1,000 BTC | Selling Dominant | Whales are dumping bags on retail at the top |

| Exchange Inflows | Increasing | Potential selling pressure for cashing out rising |

| Miner Reserves | Decreasing | Selling continues to cover mining costs and realize profits |

3. Community Sentiment: Between Fear and Greed

The mood on Reddit's r/Bitcoin, r/CryptoCurrency, and Twitter (X) is chaotic. The cheers of 2024 are gone, replaced by growing voices of blame and anxiety.

Summarizing the community reaction, we are not yet at the 'Total Despair' stage. The fact that the 'hopium' for a rebound is still running paradoxically implies that the bottom is not yet in. The real bottom is formed when everyone curses the market and leaves.

Recession Warning Signs Checklist

1. Plummeting search volume for 'Bitcoin' on Google Trends

2. Decreasing Stablecoin Market Cap (Liquidity Exit)

3. YouTube thumbnails dominated by 'Crash' and 'Ruined'

4. Macroeconomics and Bitcoin Correlation in 2026

Bitcoin no longer walks alone as 'Digital Gold.' It shows a high correlation with Nasdaq tech stocks and is swept away by macroeconomic waves.

- Paradox of Rate Cuts: Rate cuts began in late 2025, but they were defensive measures to prevent a 'Recession.' Historically, risk assets (stocks, coins) tend to fall together in the early stages of rate cuts caused by a recession.

- Regulatory Risk: A global cryptocurrency regulatory framework is set to be implemented in 2026. While bullish in the long term, it increases uncertainty in the short term, potentially shrinking the market.

5. Practical Survival Strategies for Recession

So, what should we do? Blindly selling and leaving isn't the answer. Here are survival strategies suggested by experts for a recession (or the beginning of a bear market).

Automated Trading Watch with Python (Bonus Tip)

Mechanical trading might be necessary to avoid emotional decisions. Set up alerts when the RSI indicator hits oversold territory with a simple Python script.

import yfinance as yf

import pandas as pd

def check_bitcoin_rsi():

# Download Bitcoin data

btc = yf.download("BTC-USD", period="1mo", interval="1d")

# Calculate RSI (14 days)

delta = btc['Close'].diff()

gain = (delta.where(delta > 0, 0)).rolling(window=14).mean()

loss = (-delta.where(delta < 0, 0)).rolling(window=14).mean()

rs = gain / loss

rsi = 100 - (100 / (1 + rs))

current_rsi = rsi.iloc[-1]

print(f"Current Bitcoin RSI: {current_rsi:.2f}")

if current_rsi < 30:

print("🚨 Oversold! Consider accumulating")

elif current_rsi > 70:

print("⚠️ Overbought! Consider cashing out")

else:

print("👀 Neutral zone")

check_bitcoin_rsi()- Increase Cash Position: Keep at least 30-50% of your portfolio in cash (or stablecoins) to seize bottom-fishing opportunities during a crash.

- Modify DCA Strategy: Instead of mindless buying, a modified DCA strategy that increases purchase amounts when key support levels ($60k, $50k, etc.) break is effective.

- No Leverage: This is a period of high volatility. High leverage futures trading is a shortcut to account liquidation. Stick to spot trading.

Conclusion: If Winter Comes, Can Spring Be Far Behind?

No one can say for sure if 2026 will be an 'Ice Age' for Bitcoin or just a brief 'Hibernation.' However, crisis is opportunity for the prepared investor. Rather than leaving the market in fear, I hope you calmly analyze the data and prepare countermeasures for each scenario. Only the survivors are strong. 🐻📉