"Cash is trash," Ray Dalio once said. He was half right. While paper money loses its luster, the "Digital Dollar" on the blockchain is stronger than ever. In 2026, stablecoins are no longer just chips for crypto trading. This is a war—a silent war among nations, corporations, and individuals for the future vehicle of wealth transfer.

1. Shift of Power: USDT Dominance vs. USDC Counterattack

As of 2026, the stablecoin market cap has soared well past $200 billion. This isn't just a number; it's an indicator of how fast the blood of global remittance and DeFi is pumping.

👑 The Absolute Ruler: Tether (USDT)

Tether retains the throne. Despite years of "reserve controversies" and rumors of US regulatory crackdowns, USDT commands overwhelming dominance in developing nations and offshore exchanges. People chose 'cashability anywhere' over strict compliance.

Interestingly, Tether now operates less like a crypto company and more like a massive hedge fund. Their US Treasury holdings rival those of many nations, generating billions in quarterly interest profit. This suggests Tether has reached a 'Too Big to Fail' status.

🛡️ Guardian of Regulation: Circle (USDC)

Circle's USDC, on the other hand, strategically pursued 'institutional integration'. Following its successful IPO planned in 2025, it used transparency as a weapon. Notably, its collaboration with BlackRock has absorbed massive institutional funds.

While USDC's market share trails USDT, its connectivity with compliant exchanges and traditional finance in the US is unmatched. If US stablecoin laws bite hard, Circle is poised to be the last one laughing.

📊 2026 Stablecoin Market Share (Estimate)

| Coin | Share | Key Features | Core Users |

|---|---|---|---|

| USDT | 68% | Massive Liquidity, Offshore Dominance | Traders, Global Remittance, Asia |

| USDC | 22% | Compliant, Transparent, Institutional | Institutions, US Users, DeFi |

| USDe | 5% | Synthetic Dollar, High Yield | Yield Farmers, Aggressive Investors |

| Others | 5% | DAI, PYUSD, FDUSD, etc. | Niche Markets, Specific Platforms |

"Stablecoins are no longer casino chips for crypto exchanges. They have become the fastest cash crossing borders." – Keynote at 2025 Fintech Forum

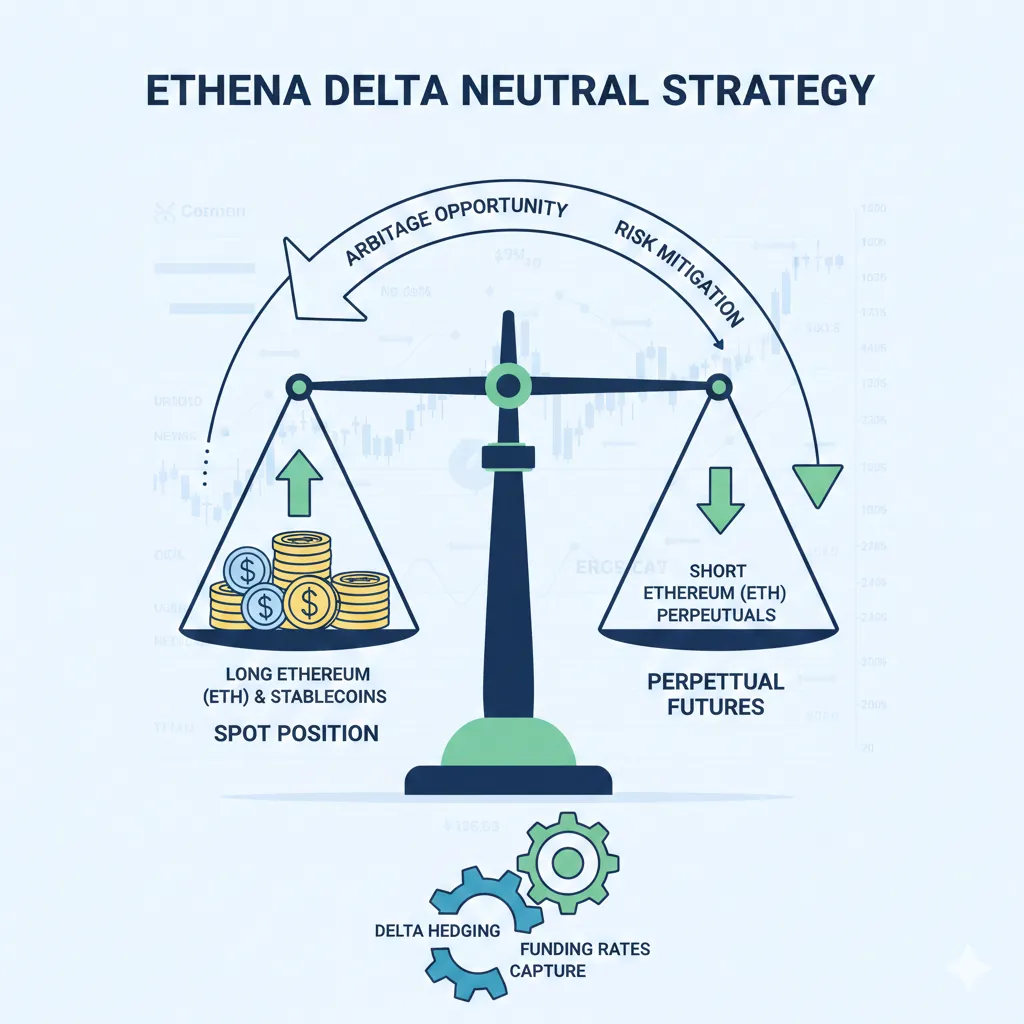

2. The Lure of Yield: Ethena and Synthetic Dollars

The star of the show since 2024 has undoubtedly been Ethena's **USDe**. Unlike traditional stablecoins backed by dollars or treasuries, USDe is a synthetic dollar using a 'Delta Neutral' strategy.

💸 Why the Hype?

The answer is simple: Yield. Holding USDT or USDC gets you zero interest, but staking USDe (sUSDe) can yield 10-20% APY. This became explosively popular when funding rates were positive in bull markets.

⚠️ Another LUNA Disaster?

However, concerns persist within the community. The trauma of LUNA dictates that "algorithmic stablecoins eventually break." Critics point out risks if funding rates turn negative or exchange risks occur. While Ethena has established insurance funds and enhanced transparency, the true test will come with a 2026 bear market.

💡 Key Takeaway: The Rise of RWA

Attempts to combine tokenized treasuries (like BlackRock's BUIDL) with stablecoins are the mega-trend of 2026. 'Zero-interest stablecoins' will lose competitiveness, and 'interest-sharing stablecoins' will become the standard.

3. Regulatory Blade: How MiCA Changed Europe

With the EU's **MiCA (Markets in Crypto-Assets)** regulation fully enforced since late 2024, the crypto map of Europe has completely changed in 2026.

- Exodus of Non-Compliant Coins: Major exchanges like Binance and OKX have delisted or restricted non-compliant stablecoins (mainly USDT) trading pairs in their European branches.

- Rise of Euro Stablecoins: EUR-based stablecoins with MiCA licenses are gaining market share against dollar dominance.

- Bank Entry: Traditional banks like Societe Generale have entered the market with their own stablecoins. Far from 'decentralization', but positive for 'safety'.

The US also tightened issuer requirements via the 'Clarity for Payment Stablecoins Act' passed in 2025. It's now a world where "coins without backing" cannot survive.

4. Community Voices: Trust vs. Profit

Debates rage on in major communities like Reddit's r/CryptoCurrency and X. Here’s a summary of real user reactions.

👍 Pragmatists

"I've heard 'USDT will implode' since 2017. Yet, only Tether has survived nearly a decade. USDT, with the most liquidity and acceptance, is king."

"Regulation? Don't care. I just need to trade futures on offshore exchanges."

👎 Purists

"Tether's audits are still opaque. When it pops, it will be without warning. I only use USDC or regulated assets, even without yield."

"Synthetic dollars like USDe are a game of hot potato. Think about where that 20% yield comes from. It's risk premium."

Interestingly, "Multi-chain Diversification" has become mainstream in 2026. Spreading assets across Arbitrum, Base, Solana, and holding a mix of USDC, USDT, and USDe is now the survival strategy.

5. Payment Revolution: PayPal, Stripe, and X

The final destination for stablecoins is not 'trading', but 'payments'. 2026 is the year this vision becomes reality.

- PayPal (PYUSD): Initially sluggish, adoption surged after integrating with the Solana network to solve speed/fee issues. Integration with Venmo was the knockout punch.

- Stripe: Since resuming USDC payments, millions of global merchants accept crypto. Freelancers now receive salaries in USDC without bank fees.

- X (formerly Twitter): Rumors of Elon Musk integrating stablecoin payments into his 'Everything App' remain hot in 2026. With X Payments securing licenses, stablecoins (along with Dogecoin) are highly likely to be used for tips and payments.

// Example: Sending USDC on Solana via Web3.js (Pseudo-code)

const transferUSDC = async (wallet, recipient, amount) => {

console.log(`Sending ${amount} USDC to ${recipient}...`);

// In reality, token program ID and decimals need handling.

const transaction = new Transaction().add(

createTransferInstruction(

wallet.publicKey,

recipient,

amount * 1_000_000 // 6 decimals

)

);

// In 2026, transfer speed is under 0.5s, fees under $0.001.

await sendAndConfirmTransaction(connection, transaction, [wallet]);

console.log("Transaction Confirmed! 🚀");

}Conclusion: Is Your Digital Wallet Safe?

The 2026 stablecoin market is a battlefield. Tether's dominance continues but is walled off by regulations. Circle grows within the walls, while Ethena tempts from outside with high yields.

As investors, we must remember one thing: The moment the belief that "1 Dollar is forever 1 Dollar" breaks, everything can vanish. Chase yields, but diversify risks. In the era of digital cash, protecting your assets ultimately depends on your 'choice'.

Which stablecoin do you primarily use? Let us know in the comments or community! 💸