"Even the national snack company..." As we enter 2026, a cold wind is blowing through the food industry. Binggrae, the first-generation ice cream company familiar to us for 'Banana Flavored Milk' and 'Melona', has announced that it will conduct voluntary retirement for all employees for the first time since its founding. This decision by Binggrae, which has grown based on a solid domestic market, is a symbolic event showing the structural crisis facing the Korean food industry beyond simple workforce reduction.

Shock Announcement: Up to 15 Months Salary Compensation for Team Leaders

Binggrae recently officially announced through an internal notice that it is accepting voluntary retirement applications from all employees, including those from Heitai Ice Cream. This is an unprecedented large-scale workforce restructuring in Binggrae's history.

The specific compensation plan is evaluated as quite exceptional in the industry. It's because they proposed a concrete 'exit plan' considering employees' livelihoods, rather than simply notifying them to "leave".

- Team Leader Level: 15 months of monthly salary + 1 year of tuition support + Health checkup support

- Team Member Level: 12 months of monthly salary + 1 year of tuition support + Health checkup support

Given the currently frozen job market, this condition comes across as a fairly realistic proposal. In particular, the '1-year tuition support' can be a significant merit for employees with children.

"This voluntary retirement is not restructuring, but a preemptive measure to respond to the changing market environment and secure a foundation for sustainable growth." – Binggrae Official

Why Now?: The Dilemma of Merger and Profitability

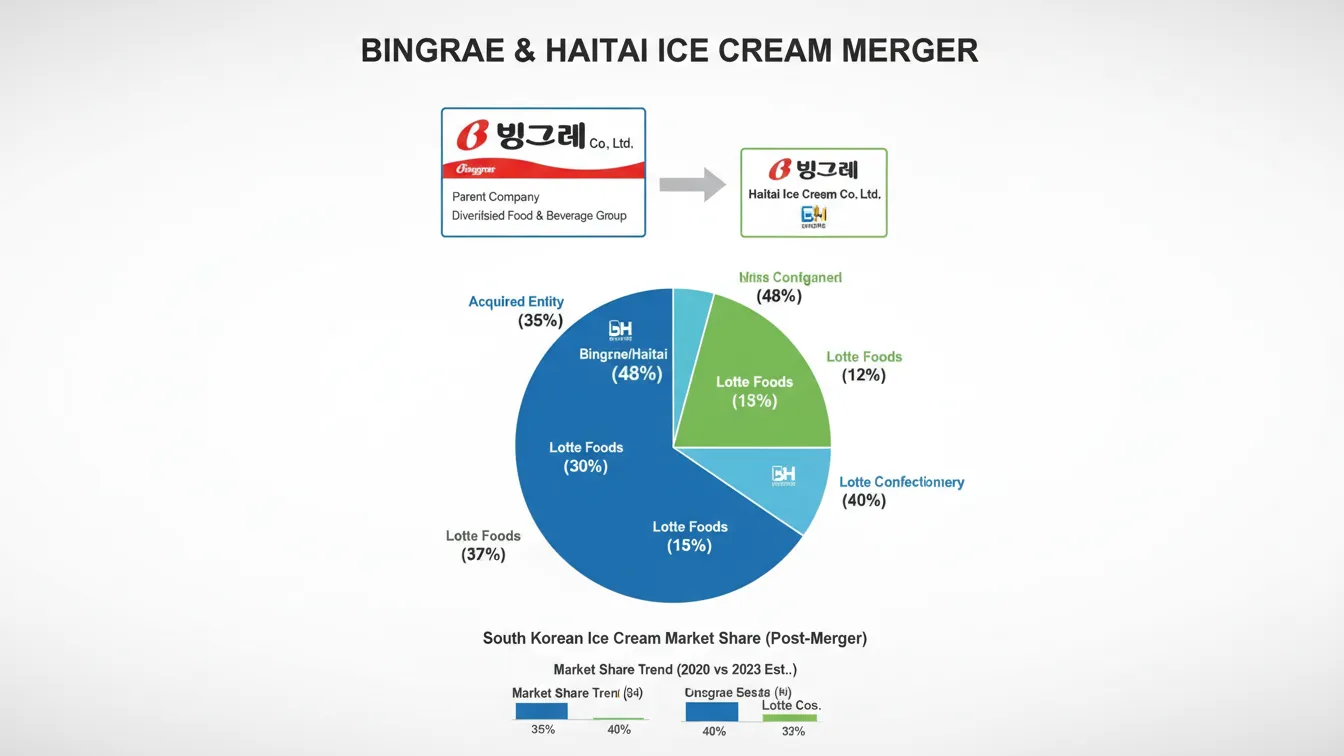

To understand why Binggrae pulled out the sword at this point, we need to go back to 2020. At that time, Binggrae acquired Heitai Ice Cream and was reborn as a 'dinosaur' in the ice cream industry. It became the dominant No. 1 operator with a market share exceeding 40%.

However, 'bulking up' came with side effects. As Heitai Ice Cream was incorporated as a 100% subsidiary and the merger process was finalized this year, overlapping functions and inefficiencies in the organization surfaced.

Binggrae drew a line saying that this measure is "not an artificial restructuring due to the merger," but industry experts unanimously agree that resolving overlapping personnel and slimming down the organization are the main objectives. 'Together' and 'Bravo Cone' became one family, but the situation has come where they have to tighten their belts in the process of combining two households.

Key Point: Meaning of 'Preemptive Measure'

This is not a restructuring done because the company is failing. The current financial status is not bad, but the intention is to improve the constitution in advance in preparation for the upcoming 'shrinking ice cream market' and 'cost burden'. This can be interpreted as a positive signal in the stock market.

Crisis in Numbers: Revenue Up, Profit Down?

Looking into Binggrae's financial statements reveals an interesting point. People often think restructuring happens when a company is in the red, but Binggrae's revenue actually increased.

// Q3 2025 Cumulative Performance Summary (Unit: KRW 100 million)

const binggraeStats = {

revenue: 11973, // Revenue: 1.1973 trillion KRW (+2.2% YoY)

operatingProfit: 992, // Operating Profit: 99.2 billion KRW (-24% YoY)

analysis: "Revenue rose slightly, but operating profit was cut by 1/4"

};

console.log(`Main cause of operating profit margin decline: ${binggraeStats.analysis}`);

Why did operating profit plummet by 24% even though revenue recorded an all-time high of 1.1973 trillion KRW? It is precisely due to the 'Counterattack of Costs'.

- Skyrocketing Raw Material Prices: Prices of key ingredients for ice cream such as milk, sugar, and cocoa have soared due to global inflation.

- Domestic Economic Recession: Consumers with thinner wallets are cutting down on consumption of discretionary foods like ice cream first.

- Seasonal Factors: Last summer, due to more frequent rain than expected and a long rainy season, they could not enjoy the 'ice cream boom'.

Especially given the nature of the ice cream industry, the fourth quarter (winter) is a traditional off-season. It seems that the management decided that it would be difficult to recover the profits lost until the third quarter in the fourth quarter.

Community Reaction: "Even 'God's Workplace' is Shaking"

As soon as this news broke, the anonymous employee community 'Blind' and various stock boards heated up. The shock was even greater because Binggrae had been called 'God-ggrae (God+Binggrae)' in the food industry for its high salary and stable employment security.

Looking at the main reactions:

- 🗣️ Employee A: "If even Binggrae is like this, is there no answer for the food sector now? The biggest problem seems to be that ice cream isn't selling because there are no kids due to low birth rates."

- 🗣️ Investor B: "I thought there would be synergy after acquiring Heitai, but did it become poison instead? Still, if they reduce costs through restructuring now, next year's performance might improve."

- 🗣️ Job Seeker C: "15 months for team leaders seems like a not bad condition? In times like these, it might be better to leave with a lump sum."

In particular, the keyword 'low birth rate' was mentioned a lot. The analysis is that the concern that the domestic ice cream market itself will structurally shrink as the child population, the main consumer group of ice cream, decreases rapidly is becoming a reality.

Future Outlook: What is Binggrae's Survival Strategy?

What path will Binggrae take after voluntary retirement? It seems they will stake their life on 'targeting overseas markets' through constitutional improvement, rather than just ending with cutting people.

Already, 'Melona' has proven its potential as a global brand by entering US Costco. In a situation where the domestic market pie is shrinking, it is highly likely that Binggrae will invest the funds secured through this organizational efficiency into overseas marketing and expanding export lines.

Also, portfolio diversification into high value-added businesses such as health functional foods or protein drinks (The Protein, etc.) is expected to accelerate. Because if they cannot transform from "a company that only sells ice cream" to a "comprehensive healthcare food company," this voluntary retirement could end up as a one-time prescription.

In conclusion, Binggrae's voluntary retirement this time is a 'signal of crisis' and at the same time a 'desperate struggle for survival'. For Banana Flavored Milk to remain by our side, Binggrae will have to be reborn as a lighter and faster organization than now.