"This is not just an investment; it's a philosophical war over the future of money." As of 2026, we stand at the center of history's most intriguing financial showdown. 'Gold,' the immutable value with 5,000 years of history, versus 'Bitcoin,' the revolutionary asset born of the digital age. Amidst inflation and economic crises, what is the true shield for your wallet?

The Eternal Rivalry: Analog vs. Digital

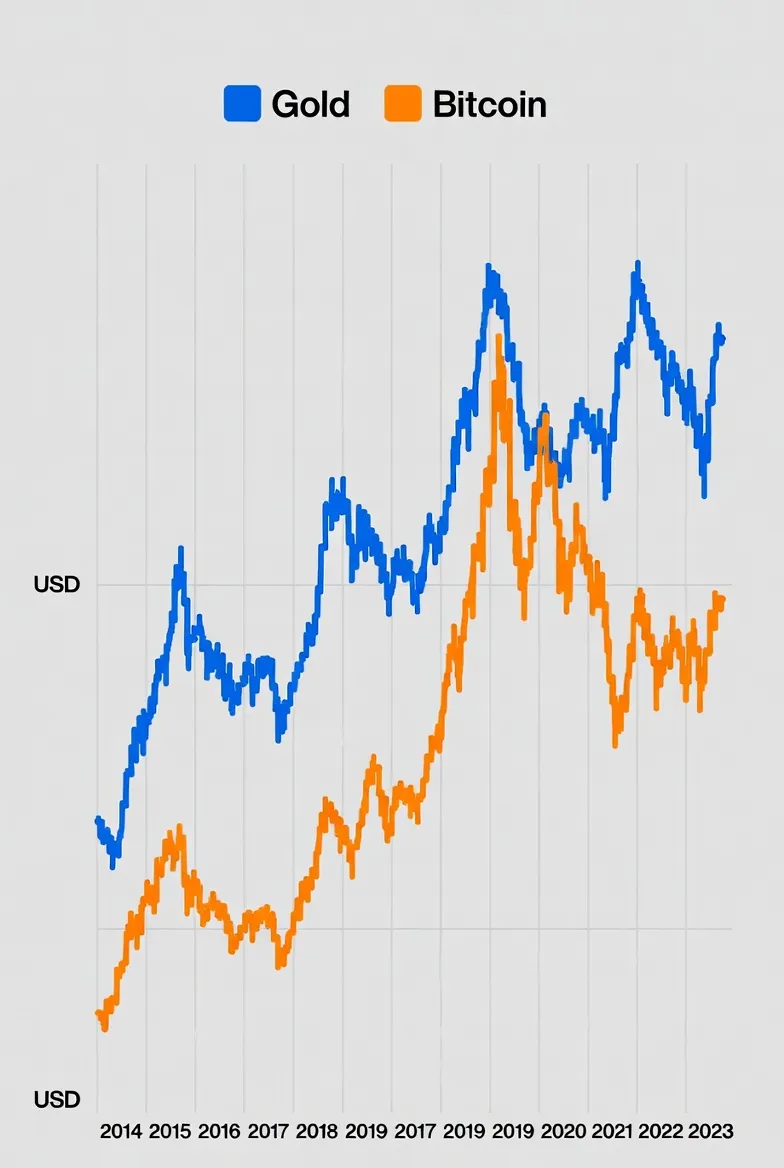

Since the approval of Bitcoin Spot ETFs in 2024, the financial landscape has turned upside down. With giants like BlackRock and Fidelity incorporating Bitcoin into their portfolios, it is no longer just "internet money" but a recognized institutional asset. Meanwhile, Gold continues to show its strength, hitting record highs driven by massive buying from central banks around the world.

Investors are confused. Seeking a safe haven, should they buy traditional gold or the digital gold showing terrifying growth? In this article, excluding emotions, we dissect both assets based on data, facts, and the latest market sentiment.

"Gold is money. Everything else is credit." – J.P. Morgan

"Bitcoin is a mathematically purified version of gold." – Steve Wozniak (Apple Co-founder)

Gold: The Unshakable Throne

Gold is the most trusted asset in human history. Even when civilizations fall and currencies become worthless paper, gold retains its value. This is the 'Lindy Effect' of gold: that which has survived long is likely to survive longer.

👑 Key Advantages of Investing in Gold

- Historical Stability: Its value has never gone to "zero" during wars, depressions, or hyperinflation.

- Central Bank Love: Central banks in emerging markets like China, Russia, and India are buying gold massively to reduce reliance on the dollar. This acts as a strong price support.

- Security of Physical Ownership: Even if electricity fails or the internet crashes, the gold in your hand does not disappear.

- Low Volatility: Compared to Bitcoin, price fluctuations are smaller, offering the comfort of a good night's sleep.

However, the downsides are clear. Storage and transport are inconvenient, verification is needed, and most importantly, it generates no interest on its own outside of industrial demand. This is why Warren Buffett criticized gold, saying it "gets dug out of the ground... and then we pay people to stand around guarding it. It has no utility."

Bitcoin (BTC): The New Hegemon of the Digital Age

Beyond the nickname "Digital Gold," Bitcoin has become the strongest competitor chasing Gold's market cap. As institutional portfolio allocation began in earnest starting in 2025, Bitcoin's volatility has noticeably decreased compared to the past.

🚀 Key Advantages of Investing in Bitcoin

- Perfect Scarcity: The total supply is fixed at 21 million. While gold supply can increase with mining technology, Bitcoin is mathematically limited.

- Overwhelming Portability: Billions of dollars in assets can be moved across borders with just a USB drive or a memory (mnemonic) in your head.

- High Growth Potential: Bitcoin, which was only 10-20% of gold's market cap, still has significant room to grow. For the younger generation, Bitcoin is a much more familiar asset than gold.

- Decentralization: Being free from the control of specific governments or institutions, it is free from geopolitical risks or asset freezing.

Of course, risks exist. It still shows higher volatility than gold, possesses potential technical flaws (though extremely low), faces strong government regulation, and carries the risk that lost passwords mean the assets are gone forever.

Key Point: Generational Shift

While Gold is trusted by the 'Baby Boomer' generation, Bitcoin has the full support of 'Gen Z' and 'Gen Alpha'. In the upcoming 'Great Wealth Transfer' over the next decade, where will the money flow?

At a Glance: From Returns to Risks

Before making an investment decision, we've summarized the characteristics of both assets in a table, reflecting the market situation in 2026.

| Category | Gold 🥇 | Bitcoin ₿ |

|---|---|---|

| Scarcity | High (But mining increases supply) | Perfect (Fixed at 21M) |

| History | 5,000+ Years | 17 Years (Born in 2009) |

| Volatility | Low (Stable) | Medium~High (Growing pains) |

| Storage/Transfer | Difficult (Physical space, weight) | Very Easy (Digital Wallet) |

| Main Demand | Central Banks, Older Gen, Industrial | Institutions, Younger Gen, Tech-savvy |

| Returns (Last 10Y) | Stable Uptrend | Overwhelming Growth |

Community Reactions: "Boomer Rock" vs. "Ponzi Scheme"?

What are real investors saying? We synthesized reactions from Reddit communities like r/investing, r/Bitcoin, and r/Gold. While extreme opinions fly, the voice for "coexistence" is growing louder.

🗣️ Bitcoiners

- "Gold is a 'Boomer Rock.' Are you taking gold bars to Mars? The future is digital."

- "As governments print money, Bitcoin rises. Gold prices can be manipulated, but Bitcoin code doesn't lie."

- "Since the ETF approval, Bitcoin is now institutional. It's no longer gambling."

🗣️ Gold Bugs

- "If the power goes out, Bitcoin is 'zero.' Gold remains even if civilization collapses."

- "You trust data fragments with no intrinsic value? Gold is used for jewelry and industry."

- "The volatility gives me a heart attack. Gold is the investment for peace of mind."

Interestingly, many investors have recently begun to perceive that "Bitcoin and Gold are not enemies." Both assets share the common goal of being a hedge against Fiat Currency Debasement.

Conclusion: 2026 Portfolio Strategy

So, what is the conclusion? It might not be a question of choosing one over the other. Experts advise building a portfolio based on your investment style and goals.

- Stability Oriented (Conservative): Gold 80% + Bitcoin 20%. If asset preservation is the priority, increase Gold allocation but include a small amount of Bitcoin to boost returns.

- Growth Oriented (Aggressive): Gold 20% + Bitcoin 80%. If you can withstand high volatility and aim for asset multiplication, increase Bitcoin allocation.

- Balanced Barbell Strategy: Hold Gold and Bitcoin 50:50, maximizing returns through rebalancing when their correlation decreases.

In 2026, the value of currency continues to be challenged. We hope you protect and grow your wealth by appropriately using these two weapons: the sturdy shield of Gold and the sharp spear of Bitcoin.